Waste-Derived Fuels: SRF Exports Remaining Strong

When the data for waste-derived fuel exports from England in October 2021 was released, it was particularly striking to see that they were the lowest since December 2012. The numbers for November 2021 presented a 34% uplift from this low, which offered some much-needed encouragement to the sector – although the glitter is dulled by the fact that the November 2021 figure was still 22% below the equivalent period in 2020. Furthermore, it is perhaps not entirely illogical for November waste-derived fuel export volumes to be greater than October, heading into Winter. Even so, the data suggests that the sector is in a cautious equilibrium, a description which could equally be applied to various industrial sectors. Unease abounds and confidence is low … and bear in mind that those November figures are pre-Omicron, so there may be further wobbles looming in the data.

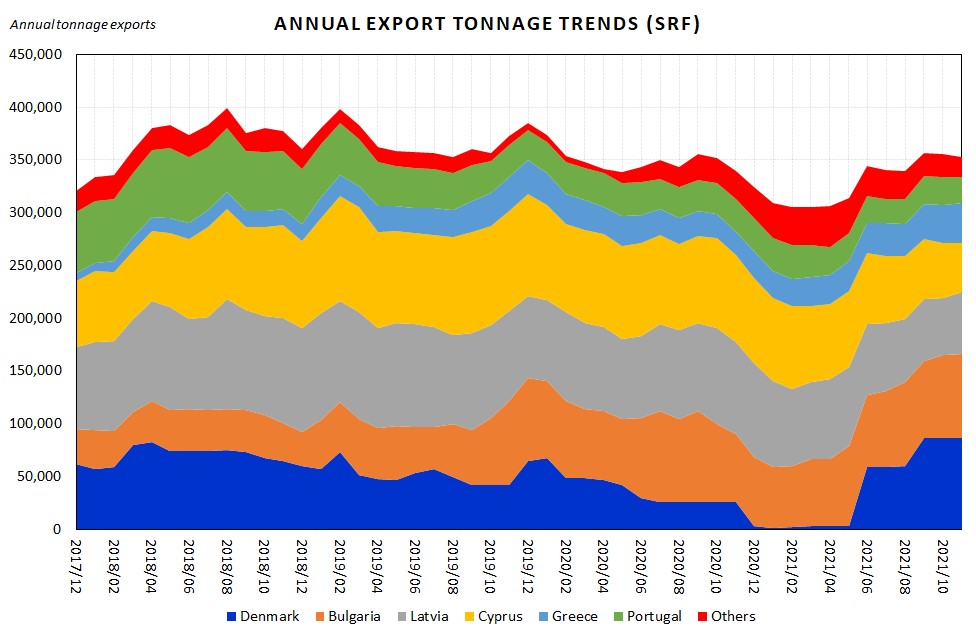

Wobbles aside (odd phrase!), take a look at Chart 1 which displays the rolling annual trend for Secondary Recovered Fuels (“SRF”) shipments, where SRF is the higher-specification product used predominantly as an alternative fuel in cement kilns, replacing heavy fuel oil. This chart extends back to the very end of 2017, which was the near the peak of waste-derived fuel exports. Since then, the global landscape has changed dramatically, and most of these changes have acted as obstacles to the export of waste-derived fuels (shortage of logistics drivers, fuel costs, pandemic restrictions etc). These macro-setbacks do not appear to have dented the shipment of SRF to cement plants, with the latest overall market position a mere 11% down from the highest point on the graph. Year-on-year, SRF exports are up by 4%, according to the latest data.

Chart 1 – Annual Export Tonnage Trends (SRF)

As the global cement industry faces existential challenges with soaring energy costs, along with an increasing burden from environmental targets and levies, the prospect of further strengthening of the symbiotic relationship between the waste management and cement production industries looks likely. Hanson Cement, for instance, includes a specific commitment to “maximise use of alternative fuels within our cement plants” in its Sustainability 2021 report. Such alternative fuels include Meat and Bonemeal from the food industry and glycerol from the biodiesel sector as well as waste-derived SRF. Similarly, Tarmac, a CRH company, is building on its sustainability strategy to set out ambitious goals for the company to use over 70 million tonnes of waste from other industries, as alternative fuels, in its processes and products by 2030.

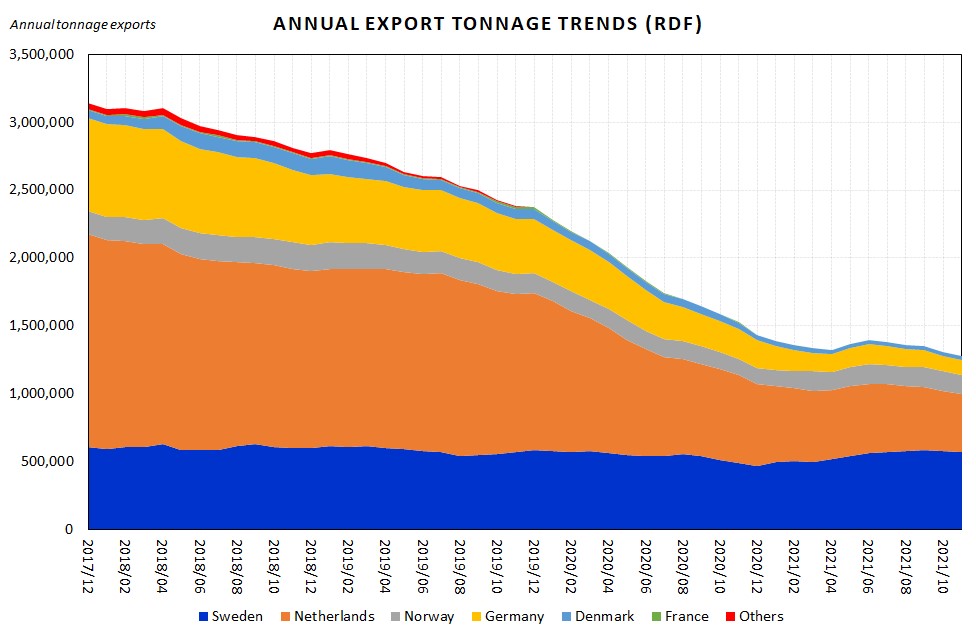

In contrast, Chart 2 (below) shows the equivalent timeframe for Refuse-Derived Fuels (“RDF”) exports, whereupon the aforementioned obstacles are quite evident, along with the negative effect of the implementation of the Waste Import Tax in the Netherlands in January 2020. There are also wider forces at play in the Netherlands and Germany in the balance between waste production and domestic capacity to treat it; both countries are increasingly able to supply their own Energy from Waste facilities with their home-processed feedstock, reducing their enthusiasm for imported RDF … and if they do need imported RDF, there are other sources beyond the UK. On a more positive note, Chart 2 presents the comparative stability of exports to Sweden and Norway, where the latest data reports year-on-year growth in exports to these countries as +14% and +17% respectively. Indeed, all bar one of the Top 10 growth outlets are in either Sweden or Norway.

Chart 2 – Annual Export Tonnage Trends (RDF)

There is a sense – just a sense – that if only the world could start spinning the right way again and if the present jitters could be eased, then the supply routes for the export of processed RDF / SRF from the UK would be able to accommodate additional tonnage once again. The significant effort made by the waste management sector over the past decade to produce fuels to the specifications of particular clients, as well as the positive working relationships that have been established in that time, will hopefully withstand the present knocks and bumps.